wake county nc sales tax rate 2019

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. County Rates with Effective Dates as of April 1 2019.

Morrisville North Carolina S Sales Tax Rate Is 7 5

The total sales tax rate in any given location can be broken down into state county city and special district rates.

. 35 rows Sales and Use Tax Rates Effective October 1 2018 Through March 31. US Sales Tax Rates NC Rates Sales Tax Calculator Sales Tax Table. Sales and Use Tax Filing Requirements.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25. Pay tax bills online file business listings and gross receipts sales.

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Wake County North Carolina is. The corporate income tax rate for North Carolina is 40.

Historical County Sales and Use Tax Rates. The corporate income tax rate for North Carolina will drop to 30 starting January 2017. There is no applicable city tax.

Sales and Use Tax Rates Other Information. North Carolina state sales tax. The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

Learn about listing and appraisal methods appeals and tax. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items. Wake County sales tax.

Form Gen 562 County and Transit. Average Sales Tax With Local. You can print a.

County Rates with Effective Dates as of July 1 2020. North Carolina has a 475 sales tax and Wake County collects an. There are a total of.

What is the sales tax rate in Wake County. County rate 6195 Fire District rate 1027 Combined Rate 7222 No vehicle fee is charged if the property is not in a municipality 85 x 7222 6139 estimated annual tax. Sales and Use Tax Rates.

There is not a local corporate income tax. Sale and Purchase Exemptions. Search real estate and property tax bills.

Paying For Local Government Local Government In North Carolina

Paying For Local Government Local Government In North Carolina

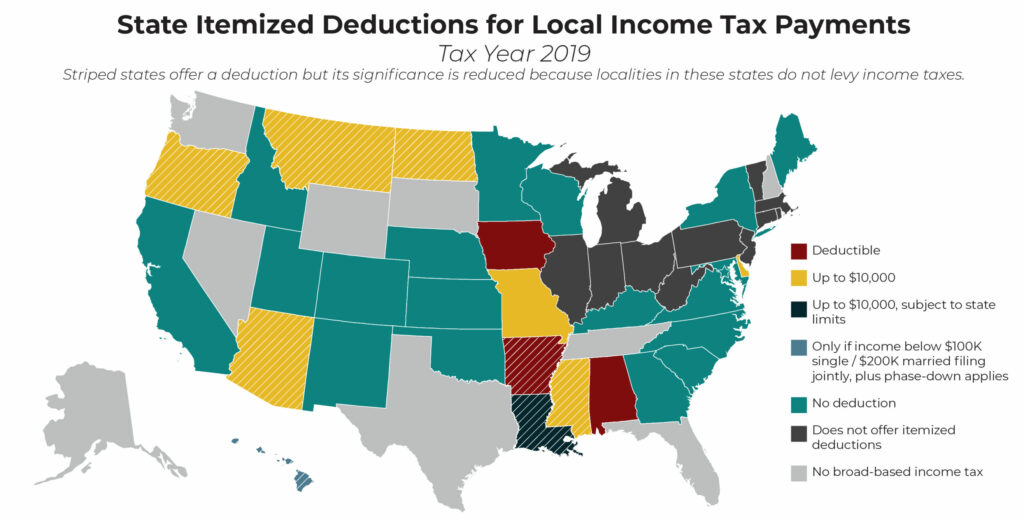

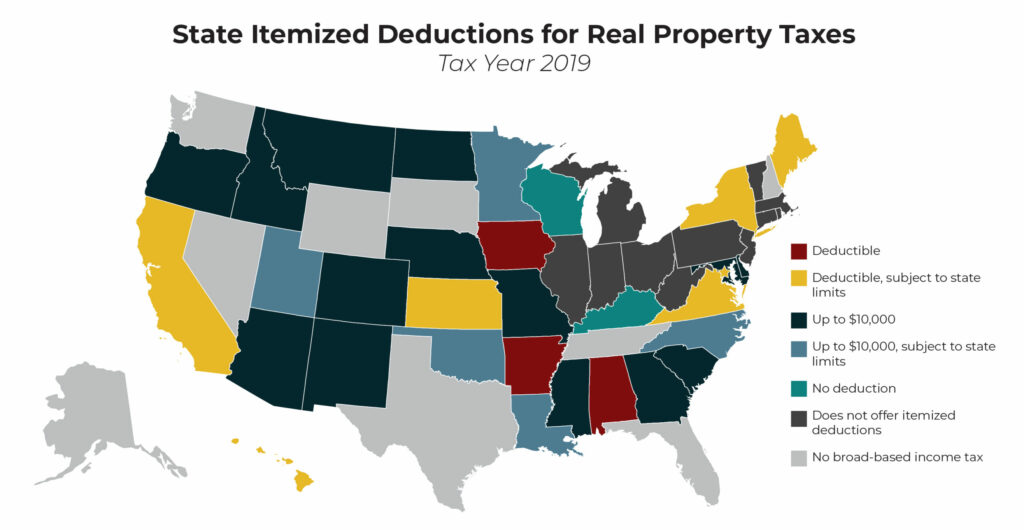

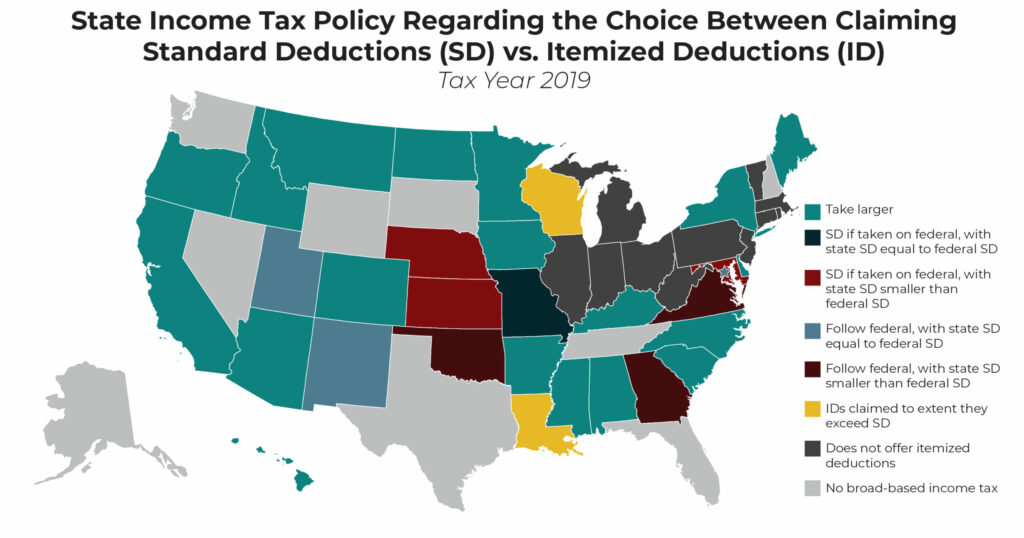

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

Should You Move To A State With No Income Tax Forbes Advisor

How Often Are Property Tax Rates Assessed In Charlotte

2021 Mileage Reimbursement Calculator

What Is The Sales Tax Rate In The Uk Quora

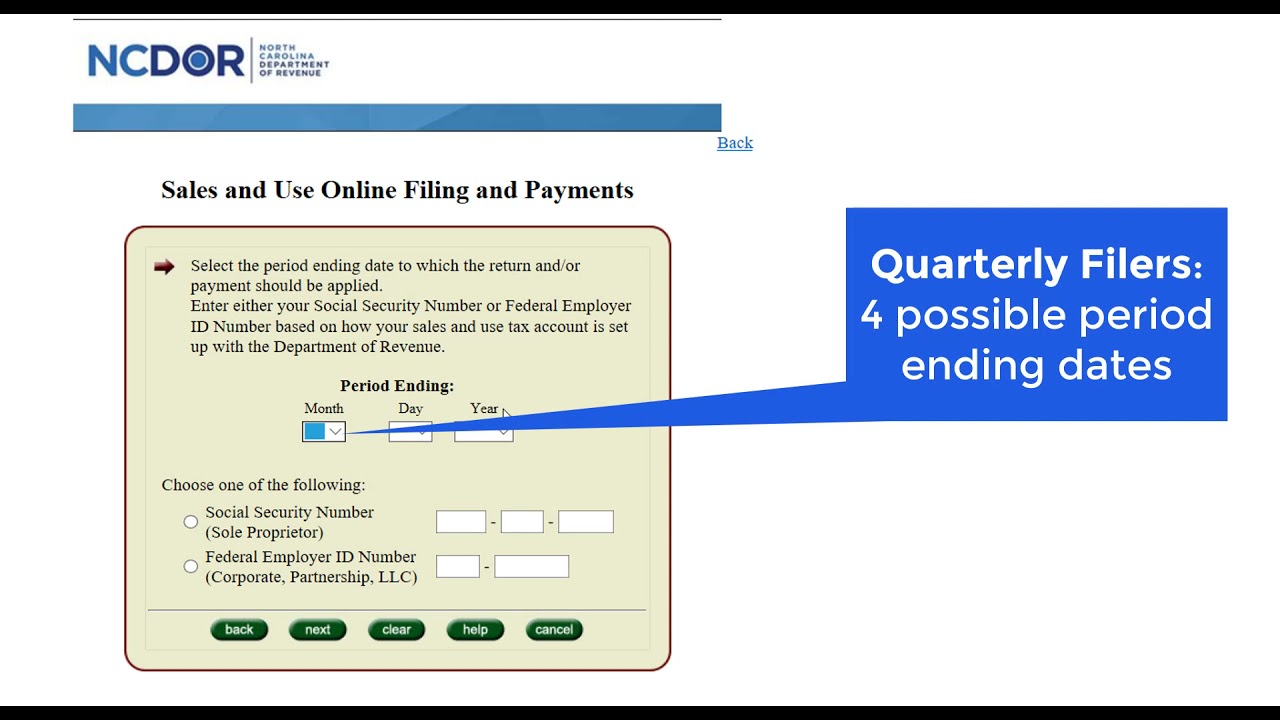

Online File Pay Sales And Use Tax Due In One County In Nc Youtube

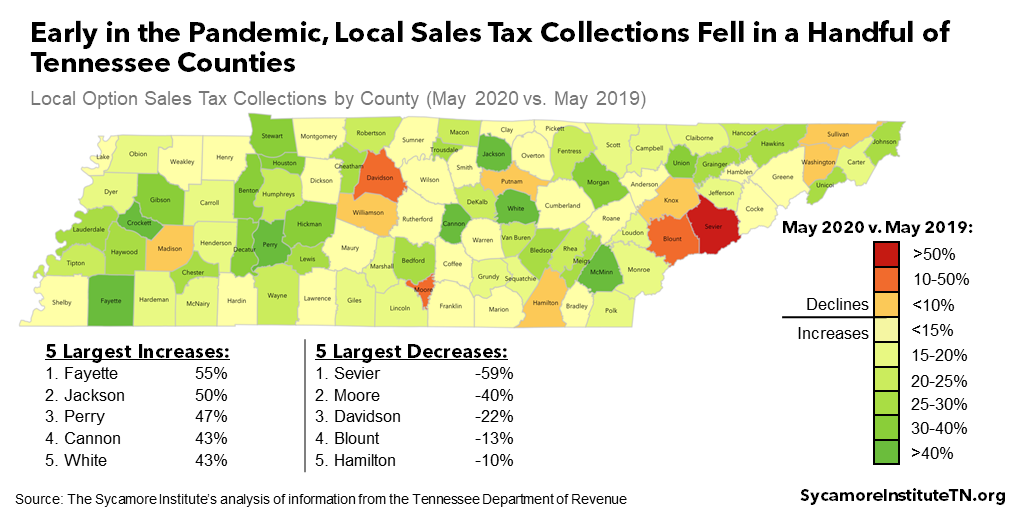

What And How Much Will Tennessee Get From The American Rescue Plan

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

Ultimate Guide To Understanding South Carolina Property Taxes

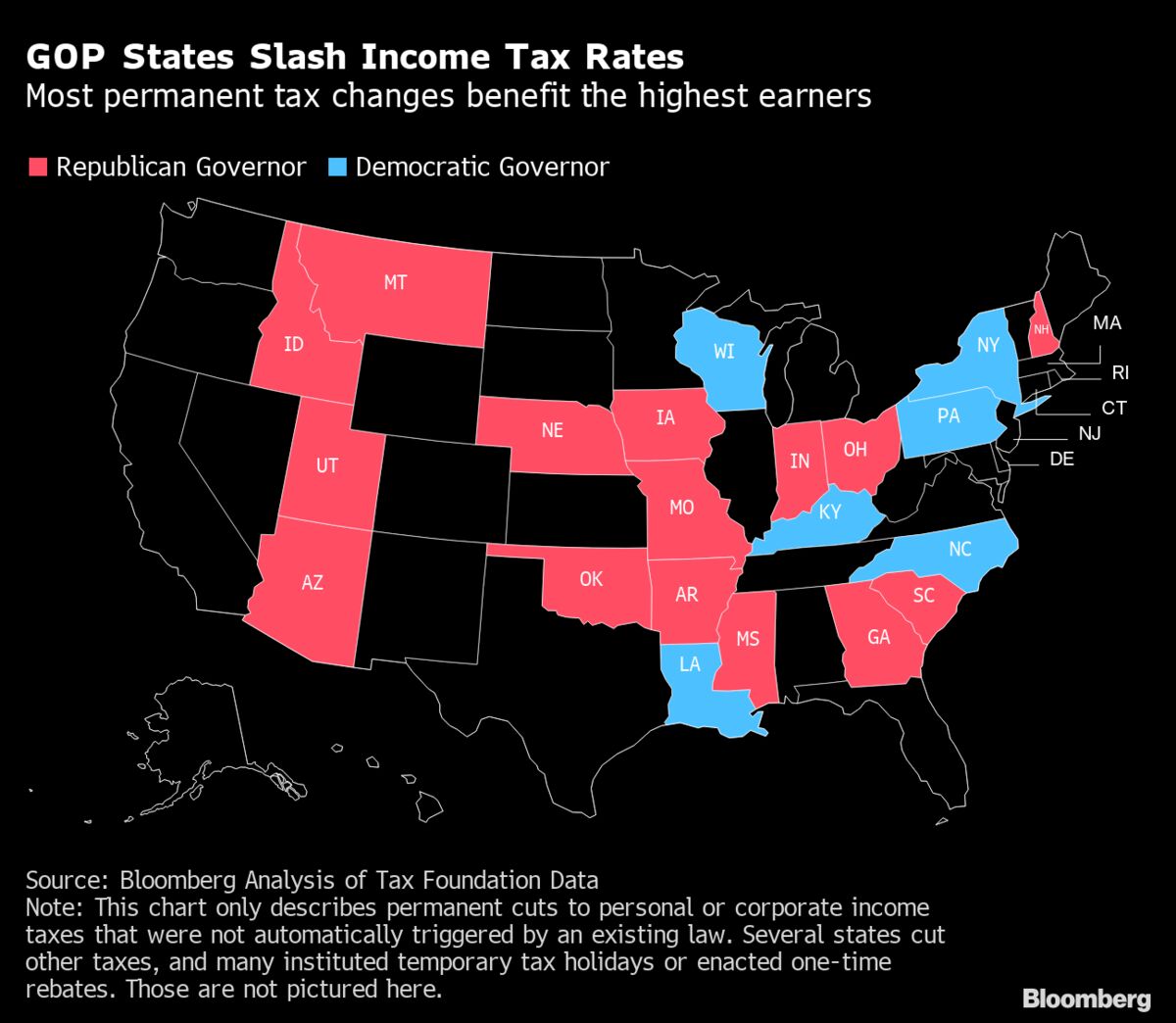

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep